The platform’s catalog share of originals in the region has increased to over half (55%) of its offer and accounts for some of its most successful titles in LatAm. Up next, we present these and other key findings from Omdia and PlumResearch’s new report.

To stay ahead in the global streaming wars, Netflix has been building its offering of non-English programming, especially in Latin America, where paid memberships hit 39.94 million at the end of 3Q22. “We want Netflix to be relevant to audiences all over the globe, and our local language titles are a differentiator for us,” said the streaming service in the letter to its shareholders in 2Q22.

In this scenario, there are many key differences and trends between the main markets in Latin America, as explained by the new report “Netflix originals: Making a difference in Latin America“, created by Omdia in collaboration with PlumResearch.

Brazil and Mexico lead the way with local production

According to Omdia, Netflix will reach 41.6 million subscribers in Latin America by the end of 2022, including 13.7 million in Brazil, 11.1 million in Mexico, and 5.3 million in Argentina. By the end of 2027, its subscriber base in the region is forecast to grow another 30% to 52.3 million.

Netflix has ramped up its production around the world with local partnerships. In Brazil, it is planning to produce 50 original series in 2022, and in Mexico, the streamer invested US$500 million in producing 40 original titles in 2021. These local-language productions serve two main purposes; they add a further layer of localization to the streaming service on top of local currency pricing, partnerships with distribution partners, and acquired content. Additionally, they could also spring international breakout hits like Squid Game and La Casa de Papel.

Unsurprisingly, the two biggest markets for Netflix in the region also saw the biggest usage in 3Q22, according to PlumResearch. In Mexico, audiences streamed 3.2 billion hours of content on Netflix, with 73.18% of that time spent on series. The Drama and Action & Adventure genres had the biggest slice of that viewership: 29.7% of all series watched were Drama, and 17% were Action & Adventure. The top three series in the quarter were: Stranger Things with 13.8 million unique viewers (UV), Extraordinary Attorney Woo (7.3 million UV), and Dahmer (6.3 million UV).

In turn, Brazilians watched 4.02 billion hours of programming during the same period, with 73.24% of that spent on series, with a preference for Drama (32.1%) and Action & Adventure (30.9%). Their top three series were Stranger Things (20 million UV), The Sandman (9.6 million UV), and Cobra Kai (9.2 million UV).

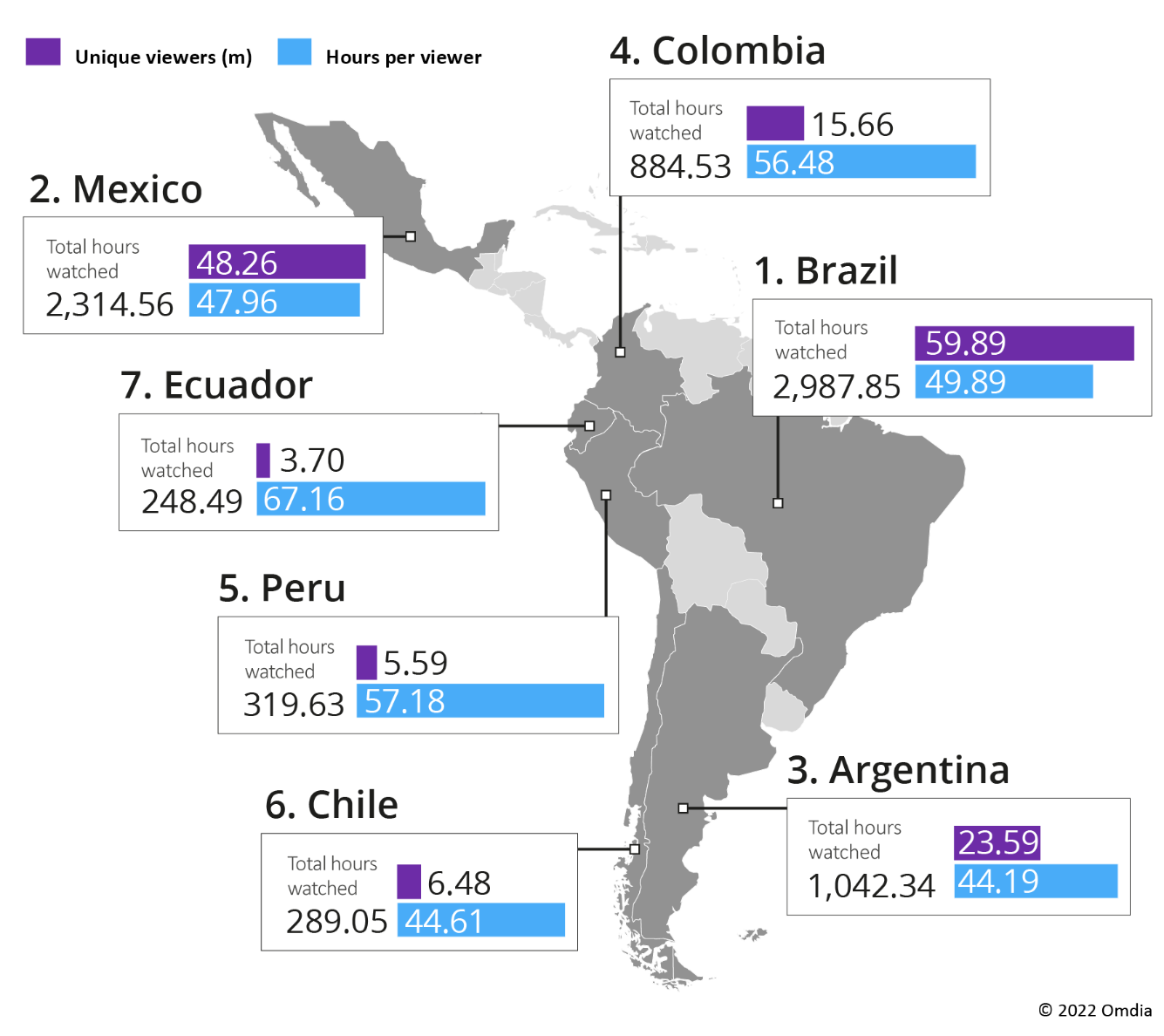

Cumulatively, these seven markets accounted for 10.83 billion total hours watched in 3Q22, an impressive increase of 7.55% from 2Q22, and a total of 129.39 million unique viewers. Netflix still has room for growth in the region.

Is there an ROI on local-language productions?

Netflix’s local-language productions serve three main purposes: they add a further layer of localization to the streaming service on top of local currency pricing and acquired content, they are a way to create partnerships with local production companies and talent, and they serve as a source of homegrown content that can be recommissioned and built into franchises.

In the best-case scenario, local investments can spring an international breakout hit like Squid Game, Lupin, or La Casa de Papel (Money Heist), to name a few shows that performed well for Netflix across multiple territories. Some of these Netflix hits even enter the cultural zeitgeist: Squid Game was responsible for a 7,800% spike in sales for white slip-on Vans, while the Dali mask from La Casa de Papel became a symbol of resistance worn in political protests across the globe.

To date, ¿Quién mató a Sara? (Who Killed Sara?), produced by Mexican studio Perro Azul for Netflix, is its most successful series made in Latin America. In April 2021, it was briefly crowned Netflix’s most popular non-English series (before being unseated by Squid Game in September) and even held the number one spot on the top 200 series list for two weeks in the US, according to PlumResearch’s data.

However, apart from Who Killed Sara?, has Netflix’s investment in local language TV shows been paying off in Latin America? PlumResearch looked at audience consumption in 3Q22 in the seven Latin America markets and extracted the total hours watched (THW) data for all Netflix original series, for all series produced in Latin America (whether originals or acquired), and for all Netflix original series made locally in a Latin American country.

Brazilians spent the most time watching Netflix original series, with almost 42% of their THW going toward these productions. Ecuadorians spent the least time, and consumers in the other five markets fell somewhere in the middle. For context, US viewers spent 45.84% of their time on Netflix’s original series during the same period.

In fact, as the number of originals in the Netflix library has grown, users in all seven Latin American markets have shifted to spending more time on these titles.

From this perspective, Netflix’s drive to develop its originals to retain subscribers is working: the region is seeing subscriber growth while popular licensed content, like Daredevil or The Defenders, has left the service and powerhouses like Encanto—which previously would have gone to Netflix—are now exclusive to Disney+.

In comparison, the time spent on locally made original series initially looks abysmal—below 5% in all seven markets, according to PlumResearch. However, this is because there were only 44 Latin America–produced series and movies combined released on Netflix in 2020, according to Omdia. Brazil and Mexico had the lion’s share, with 15 new productions each.

According to PlumResearch, the consumer demand for local-language content is clear. In Mexico, 12.5% of the time consumers spent streaming all series in 3Q22 went to Latin America–produced content, both acquired and originals. The other six markets show a similar trend; thus, as Netflix continues to ramp up local production in the region, we expect these viewership numbers to grow markedly.

Top local titles performed well across all seven markets

With Netflix determined to expand its footprint in Latin America, the streamer has commissioned fiction series and films, documentaries, and reality TV shows. To see what was really resonating with audiences in all seven markets, PlumResearch pulled the top 10 local-language series from 3Q22. In all, eight titles featured in the top 20 of local original titles in all seven markets: five Mexican series, two from Brazil, and one from Argentina.

Control Z was the top performer, aggregating 12.2 million unique viewers and 56.0 million THW across all eight markets. The teen-targeted drama series was created by Lemon Studios, and its third and final season launched in July 2022. Including Mexico, Control Z was the top-performing Latin American original in every Spanish-speaking territory in 3Q22.

Donde hubo fuego (High Heat), a crime drama created by José Ignacio Valenzuela, recorded 9.7 million unique viewers and 71.1 million THW (the first season launched in August 2022 with 39 episodes. The drama was placed number two in every Spanish-speaking market in 3Q22.

Bom Dia, Verônica (Good Morning, Verônica), a female-centered crime drama from Zola Filmes, was the most successful Brazilian series in the quarter. Its second season premiered in August 2022 and drew 8.9 million unique viewers and 43.6 million THW across our eight countries. It was the third most-viewed Latin American original in Argentina, ahead of six local shows in the top 20.

Argentinean show Go! Vive a tu manera (Go! Live Your Way) is an interesting example of slow-burning success: the musical and romance series was canceled after two seasons in 2019. In 3Q 2022, the series racked up 885,000 unique views across eight markets.

Sintonia, as well as being a success in Brazil, traveled to Spanish-speaking countries, appearing among the top 10 shows despite missing out on the top 20 in three of our five countries. Meanwhile, other series—such as Brazilian comedy Unsuspicious and Club América vs. Club América, a Mexican example of the growing sports documentary genre—performed sufficiently well in their home markets to be number 10 and number 11, respectively, in our list.

For comparison, the report also looked at the top-performing Netflix originals of any nationality in the region. Stranger Things, which unrolled its fourth season in July 2022, registered 51.1 million unique viewers, more than 4x as many as Control Z. The Mexican series would have come in at number 9 of the regional top 10, between a Turkish movie, Another Self, and the Italian/UK teen drama Fate: The Winx Saga.

This is in line with what we have seen in other international Netflix markets: the success of the platform really is driven by global hits, even at the local level.